Earthquake in the Chinese financial ecosystem: WeChat now accepts Western credit cards

Why this took 10 years, and what the tricks are to make it actually work.

View from China with an Austrian School of Economics Perspective

As mentioned in a previous commentary, over the past few years China’s domestic payment processing systems have become increasingly cut off from the rest of the world, with tourists and new arrivals in China often forced to make do with cash payments only, a limitation which prevents them from participating in China’s digital economy. This past Thursday it seems the dam finally broke.

We live in revolutionary times.

After only 10 years, almost to the day, last Thursday Tencent (腾讯), the operator of Wechat and WeChat Pay, announced that it was opening up WeChat Pay to Western credit cards. Russian Mir cards remain out in the cold.

Payments of up to 60,000 yuan per year will be permitted.

Moreover, it’s not a “coming soon” announcement. According to reports from three different users, payments actually work – for the most part.

Did all of our complaints make a difference?

Or was it the upcoming Asian Games in Hangzhou, as this article by Baidu claims?

And… why did it take them so long??

As any experienced Austrian-minded observer will be able to guess, the delay was entirely due to government regulations.

These regulations go back to December 2015, when the government implemented a collection of restrictive measures in an apparent attempt to protect the monopoly position over payments previously held by state-run UnionPay.

With UnionPay losing its stranglehold on the payment market to privately-run Alipay and WeChat, as usual the government took measures not to challenge UnionPay’s monopoly but rather to protect it. It was a textbook illustration of the Austrian observation that the maintenance of monopolies requires government protection.

The regulation issued at the time was full of various complicated limitations on payment amounts, not all of which are completely clear. While the wording is highly convoluted, the regulation seems to limit payment processors to a cumulative maximum of 1,000 CNY per person for persons lacking face-to-face identity verification.

This tactic did not however succeed at stopping either WeChat or Alipay. After extensive internal struggles a method was found to implement this “KYC” verification via the banking system. In the end, the attempt at protecting UnionPay’s previous monopoly was a complete failure. What happened instead was that these measures ended up hitting a completely unintended target: foreign tourists.

Why? Tourists rarely have Chinese bank accounts, so neither WeChat nor Alipay were able to verify tourists who lack them.

As the Wechat/Alipay duopoly became increasingly dominant, this slowly morphed into a big problem, because more and more vendors simply stopped accepting anything else besides the big two payment processors and cash. With 99% of consumers happy to pay via QR code, POS terminals have become largely superfluous. These days both credit cards and debit cards are essentially dead in China, with only very large institutions accepting either. And even in the rare cases where credit cards are accepted, foreign cards usually fail to work.

While the convoluted 2015 regulation mentioned above theoretically remains in effect, as of July 20th, clearly some new arrangement is in place, since (a) tourists now no longer require any “face to face” verification in order to be able to use WeChat Pay, and (b) at a minimum Visa and Mastercard can not only be added as payment methods, but can actually be used to pay for stuff.

Tencent published a guide in English on how to set this up, but we have addressed a few points which they left out:

Which cards are in theory eligible?

Visa, Mastercard, Diner’s Club, Discover and JCB. Notably the Russian Mir card is missing from the list, a fact which will doubtless be seen as a diplomatic slight. Amusingly, Chinese domestic credit cards don’t work either.

Who can use this new setup?

Apparently anyone. Users who are not yet “verified” need to upload a copy of their passport and fill out an information page, but that seems to be it. Domestic Chinese users can also add eligible foreign credit cards to their accounts and use them.

What’s the limit?

The maximum permissible charge is 6,000 yuan in a single transaction. The current yearly limit per account is 60,000 yuan.

How/when do you select which card to charge?

WeChat Pay does not seem to have a default payment source setting. Instead, it suggests whatever you used the last time. The payment source can be changed in the final step, AFTER pressing “Pay”. Besides selecting a card, if you have a balance in your WeChat wallet, you can of course also choose to use that as the payment source.

How do I actually go about paying someone?

The most common method for small vendors, such as those you encounter at the marketplace (菜市场), is to provide a QR code for customers to scan. After scanning the code, you enter how much you want to pay, select the payment source and enter your pass code.

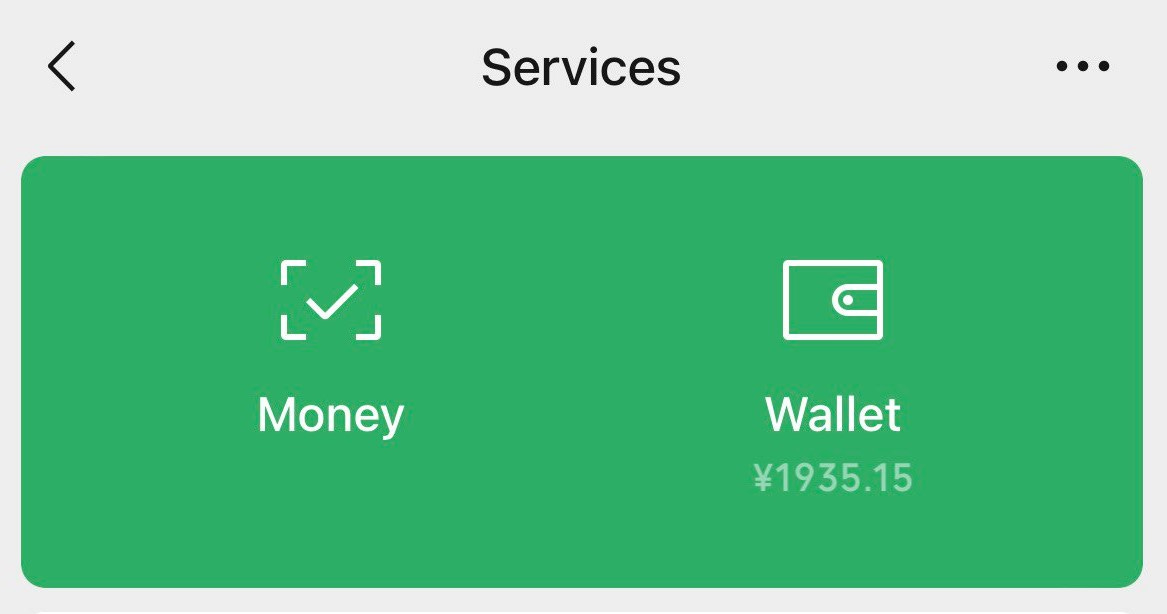

The second method is to allow the vendor to scan you. This is more common in stores. In that case, you select Me -> Services -> Money (in the English version) to display your payment QR code. In reality “money” means “payment code”. In the Chinese version this is labeled “收付款” – which is much clearer if you read Chinese. The meaning of “Money” here is not exactly obvious, which is another reminder that no-one at Tencent felt it necessary to make this intelligible for foreigners. The vendor or the vendor’s scanner scans this code and WeChat prompts you to enter your 6 digit pass code to confirm the amount.

What can you pay for?

With the exception of a few online platforms associated with Alibaba, most merchants accept WeChat Pay, including Jingdong / JD.com (京东). To use foreign credit cards on Taobao, see the section below. However, you can’t use foreign credit cards to do balance top-ups, person to person transfers or send gifts (红包).

What are the fees?

If the total charge is equal to or less than 200 yuan, WeChat charges no transaction fees. For amounts over 200 yuan, the fee is 3%.

It’s not clear if there is any limitation yet on the number of charges with a single vendor; however, given the additional fees charged for amounts over 200 yuan, at some point in the future it’s a fair guess that a limitation is likely. In such a case, using a different credit card for the second charge might be a workaround. Currently this works.

How about other financial products?

As a foreigner, you can also forget about products such as “Wealth” or “Insurance”, even if you are verified. After you go through all the rigmarole questions and enter an amount to invest you will see a popup that only Chinese with a verified personal identity card qualify. No doubt this is once again due to government regulations discriminating against foreigners.

What about Taobao / T-Mall?

While Taobao does not accept WeChat Pay, if you identify yourself as a “Global” user (我的淘宝 -> 设置), it does support foreign Visa and Mastercard cards. The charges appear as domestic US charges in US dollars.

If you see an amount calculated in HK dollars, Taobao will attempt to charge your card via Alipay Hong Kong. This may happen if you are using a Hong Kong IP address. If your credit card is not from Hong Kong, this will probably not work. Instead, try again using a domestic Internet connection and Taobao Lite (a different app) instead of the full Taobao version.

If the charge fails, try again using an Android phone.

If the charge is initially rejected by your bank as suspicious, Taobao irritatingly refuses to remember the card details, so you will have to reenter everything if you wish to try again. Once a card has been charged successfully, Taobao offers it as a payment option for future transactions.

The fee is also 3%, but unlike when using WeChat Pay, there is no exception for small amounts.

What issues have cropped up thus far?

1) The version of WeChat available on GooglePlay does not seem to work yet. It keeps prompting users to update to a new version, but no such version is available. As a workaround, WeChat Pay’s customer service hotline (95017) suggests downloading the APK file directly from its site via this link. The minimum required version is 8.0.40.

2) Not all vendors work yet, but most do. The reasons are not entirely clear, but basically it seems that they have not yet worked out all the kinks.

Where do I call for support?

WeChat Pay has a customer service hotline with an English option: 95017. Their English isn’t great, but they do seem motivated to actually resolve problems should they arise. Thus far, apparently Taobao has no customer support hotline.

Update #2: On Friday July 21st, one day after WeChat, Alibaba announced that it was also offering support for international cards. According to an article on Caixin Global published in late June, Alipay has a limit of 3,000 yuan per transaction instead of the 6,000 yuan limit which WeChat Pay has; however, this may be out of date. The other fees and limits (e.g. 60,000 yuan per account per year) seem to be the same. See https://edition.cnn.com/2023/07/21/tech/china-alipay-wechat-pay-international-credit-cards-intl-hnk/index.html. Customer Service: 0571-26886000.

Thanks for sharing! I downloaded the APK and followed the instructions. It asks for a credit card, then all of my personal info, then a photo of my passport, then a photo of myself. Now it says "ID photos are being reviewed". It feels exactly like signing up for Wise or Revolut.

It's interesting that you are not allowed to invest, gift money or build up a balance. The yearly limit for all payments is 7,500 euro. This matches with the idea that China is is discouraging inflow of foreign reserves.

In The Netherlands, Apple blocks banks from providing their own payment software, and forces them to use Apple Pay. Google sort of allows custom NFC clients, but makes them hard to use. So we ended up with a Google Pay / Apple Pay duopoly. I've always hoped WeChat or Huawei would provide a much needed 3rd player!