China’s Economy – The Good, the Bad and the Ugly (Part 2)

Modern manufacturing is an intricate process: how China became the world’s factory.

View from China with an Austrian School of Economics Perspective

This Part 2 quotes extensively from a June 2023 Substack piece published by SL Kanthan. While his perspective is not an Austrian one, he did an exceptional job at explaining why manufacturing is so important and how China became the world’s industrial heartland. While we don’t share his take on all things, his work is very thorough and worth following. Quotes from his piece are italicized, though these include some minor corrections.

Part 1 is here.

With the exception of fresh food, most of the things around us come from manufacturing, yet few of us (including most of the advocates of “decoupling” the West from China) have any idea how much complexity is involved. Your smartphone, computer, your house, your office building, your clothes, household appliances, cars… all of these things came from a chain of factories, each dependent on several others as part of an extraordinarily complex supply chain.

These things constitute wealth, and are what differentiates modern society from the subsistence based economies which characterized much of human history.

One of the central themes of Austrian thinking has always been to draw attention to what is under the hood, what remains unseen. We all see the skyscrapers, the flashy cars and planes, and of course the full shelves in supermarkets, but how many have an appreciation of the systems which make all of that possible? Not many.

Moreover, no one person alive today is able to produce any of these things on his own. The collective knowledge and know-how of scores of people are required, typically in combination with all kinds of equipment designed and built in times past, often by people who are now no longer alive. In addition, a functioning price system plus an efficient logistical system are needed to coordinate and connect all of these pieces together. Lots of moving parts.

In 1958 Leonard Read published his classic “I, Pencil” to illustrate this. His intent was to show that all of the above applied to even something as simple as a pencil.

He succeeded masterfully. As Lawrence Reed put it, many readers never see the world quite the same again.

Going back in history, the world was transformed in the 18th and 19th centuries by the industrial revolution, which was founded upon manufacturing. The rise of numerous countries like the UK, USA, Germany, Japan, South Korea, and now China was founded upon a robust industrial sector. Every successful major economy in modern history built its wealth on manufacturing.

Yet, thanks to globalization and the huge trade deficit which the USA has been accumulating for decades, only 3% of the American population now work in manufacturing.

SL Kanthan writes:

This has consequences not only for the civilian economy but also for the military industrial complex. For example, the CEO of Raytheon – one of the world’s largest military/weapons manufacturers – recently admitted that decoupling from China is not an option because his company depends on thousands of Chinese suppliers. Similarly, US fighter jets and missiles cannot function without rare earth minerals, permanent magnets, and critical chemicals, minerals and alloys from China.

As another example, consider India. 75% of medicines made in India depend on raw materials (or API) imported from China. Also, 80% of smartphones in India are Chinese brands. And when India needs to dig tunnels for its metro system in Mumbai, all the machines – even the Western brands - are manufactured in and imported from… China.

Going back to the US, the widespread ignorance about manufacturing is revealed by numerous false claims since 2015, starting with Trump. Americans were told and are still being told that (1) Chinese only make cheap, low-tech products (2) it’s easy to offshore manufacturing from China to other countries (3) trade wars and tariffs will bring manufacturing back to the US.

Manufacturing is a multi-step process

There are myriads of misconceptions about manufacturing, simply because we are not exposed to it and the mainstream media does an awful job of explaining it. When was the last time you have visited a factory that makes steel or plastic, bicycles or cars, televisions or washing machines? For most of us, the answer would be “never.”

Thus, when you ask someone about, say, manufacturing of an iPhone, they conjure up an image of thousands of low-wage workers assembling the smartphone. This is a travesty! Why? Because the assembly of smartphones is the very last step in manufacturing. We don’t talk about the actual manufacturing of the 200 or so components that go into the iPhone.

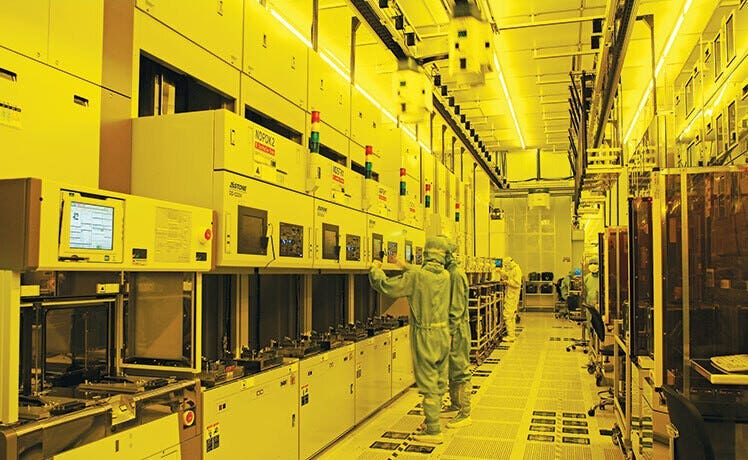

Think about all the sophisticated and hi-tech items in an iPhone: the touchscreen, myriad of semiconductor chips, battery, speaker, camera and so on. All those components require tremendous investments in highly sophisticated manufacturing facilities. Manufacturers of these hi-tech parts also need expensive scientists with PhDs in electrical engineering, materials science, physics, math, chemistry etc. As for the iPhone’s CPU, only two companies in the world – TSMC from Taiwan and Samsung from South Korea – can make them. And that requires billions of dollars of investment in semiconductor fabs.

Thus, the complex and advanced aspects of manufacturing are hidden from the mainstream narrative. I think this is done deliberately by Western media to justify offshoring all these jobs. The hidden and explicit narrative is “manufacturing is dirty and lowly, so don’t worry about us sending those jobs abroad.”

How manufacturers lower prices

Okay, now, let’s demystify one more perception about manufacturing: That cheap goods are inherently bad.

There is obviously some truth to it. More expensive goods are usually of better quality. A BMW 7-series is probably better than a Toyota Corolla. However, sometimes the higher price is purely due to marketing. You can buy a Louis Vuitton t-shirt for $100, but is it really worth it?

The real marvel to be discussed here is how manufacturers can lower the price of a product without compromising quality.

(1) The first method is to increase the quantity of production. This is the benefit of scale, as described by Wright’s Law. This is the reason why even the most advanced smartphone CPU costs only about $100 even though it requires a billion-dollar fabrication facility. When Apple sells 200 million phones a year, the cost per component goes down. The scaling factor is also one of the key secrets of China’s success in manufacturing. This is why even after five years of trade wars, China still remains America’s #1 source for apparel, furniture, bedding, lamps, toys, sports equipment etc. However, many people don’t understand this simple scaling process and denigrate Chinese products. By the way, it’s not easy to scale – you need to invest in more or bigger machines, employ more people, perhaps build new factories altogether, improve supply chain, and so on.

(2) The second method to improve productivity is to create more efficient processes. This was Henry Ford’s secret. He created the modern assembly line, which enabled more Ford cars to be built. The Japanese also excelled in this efficiency. Of course, the process is not just limited to the factory floor but every aspect of the operation – from procurement of raw materials to shipment of final products. Basically, it’s about how to do things faster and better.

(3) The third answer is innovation. For example, a Chinese company named Gotion (国轩高科) just came up with a new battery for electric cars costing 25% less than the existing ones. The secret? Rather than using nickel and cobalt – which are relatively more expensive - the LMFP battery uses Lithium, manganese, iron and phosphate. Recently Chinese companies also have invented a sodium-ion battery, which by eliminating lithium promise to be even cheaper. This approach was epitomized by BASF’s erstwhile advertisement slogan: We don’t make the products you buy. We make the products you buy better.”

(4) The fourth solution consists of cheaper raw materials and intermediate goods. For example, think of all the products that have steel or plastics. Obviously, the manufacturers of these goods can lower the price of these goods if the raw materials – steel and plastics – are cheaper. Similarly, cheaper intermediate goods will also lower the price of the final products. For example, cheaper hard drives can lower the price of a laptop.

(5) Mastery of end-to-end supply chain. For example, BYD is the world’s #1 electric car company in terms of units sold. It has 30+ subsidiaries that make everything from batteries and semiconductor chips to every mechanical and electrical component. This is why BYD can offer a decent electric car for $11,000.

Note: As mentioned in the introduction, ultimately no company on the planet controls its entire supply chain. What plays a role in efficiency is the degree to which they are integrated. Physical proximity obviously makes this easier. More on this below.

(6) The sixth solution is the use of automation and robotics.

Tesla’s Gigafactory in Shanghai will churn out almost a million cars this year, not because of countless number of Chinese workers but because of robots. China buys half of all industrial robots in the world. That’s one of the secrets of its success.

The Cotton & Textile Industries

The cotton and textile production industries offer a good case in point. If we look at cotton yields per hectare, Chinese farmers are 4.5 times more productive than Indian farmers. So how did China do it?

(1) Research into better seeds (requiring labs and scientists)

(2) Automation of the sowing and picking processes

(3) Automation of the production of cotton thread.

(4) An ecosystem with mostly nearby companies supplying dyes for coloring, buttons, labels, zippers and so on.

(5) A vast pool of skilled laborers. (Consider the case of Shein, a $100-billion ultra-fast fashion Chinese company. It makes more than 1000 new products every day!)

(6) Large scale factories for 1000+ workers including living facilities.

Other success factors in manufacturing

Here are a few other factors essential for success in modern manufacturing.

(1) Design to prototype to production

There are many steps in manufacturing before assembly, the pictures of which we are accustomed to. The first step is designing products – a process that requires a lot of creativity and specialized skills. Think of IKEA, a company that turned furniture into a cool thing and a profitable business. But the people who manufacture for IKEA must also be smart to turn ideas into prototypes and finally into mass production. Similarly, Shein, the multi-billion-dollar Chinese company we mentioned earlier, can turn an idea to a product in just 10 days, while its competitors like Zara take twice as long.

American companies who are trying to offshore manufacturing to other countries are finding out the truth about skills. For example, a Vietnamese manufacturer may take a month to create a prototype, while a Chinese company may take three days.

(2) Scalability and Flexibility

A good manufacturing facility should be able to scale up and down – think of big demands around Christmas season or special holidays or events. And the factory should also be flexible and adaptable. New products, new designs, new components, new features, new constraints, new technology? The answer to all of those should be “no problem!”

(3) Infrastructure

Factories must have land, electricity, water, buildings, warehouses, roads, internet etc. And they must be affordable and plentiful. These may sound easy, but developing nations – or even some parts of the US and Europe – may struggle to provide high-quality infrastructure. In Europe, the anti-Russia sanctions have backfired and crippled many crucial industrial sectors due to increased cost of oil, gas and electricity.

Look at the electric car sector in China. Last year, China made and sold 6 million EV, accounting for 58% of the global market share. One of the reasons for this astonishing success is infrastructure – i.e., chargers. The Chinese government, with partnership of private firms, has built millions of public and private chargers. Without that, EV cannot take off.

(4) Transportation

Although this falls under infrastructure, it must be spelled out. China is a great example for this. Fast freight trains (some of them are even re-designed bullet trains) … large sea ports that can handle massive ships and 270 million TEU containers a year … new strategically located airports all over the country … freight trains that can travel thousands of miles (like from Xian, China to Barcelona, Spain) … these incredible things underpin China’s success in manufacturing. Meanwhile, freight trains in India go at an average speed of 25km/h; and in the US, there are 1000 derailments every year.

(5) Ecosystem aka Supply Chain

If there is one most important factor that has prevented foreign companies from quickly leaving China, it is the ecosystem.

This is China’s unique secret sauce. There is an ecosystem for every kind of factory. For example, consider Tesla’s Gigafactory in Shanghai. Tesla cars made there get 95% of the components from Chinese suppliers. There are literally thousands of individual parts in a car. And China has created an ecosystem of manufacturers that can cater to every need. The proximity of suppliers dramatically decreases cost and increases productivity of factories.

What about government support?

Mr. Kanthan concludes his article with a section on the role he sees government playing. To close out this overview, let’s take a look at that.

He mentions tax-breaks, subsidies, incentives, trade agreements and explicitly “visionary” government planning. He also assigns an “indispensable role” to state-run enterprises, mentioning a need for “cheap steel” and “cheap electricity” as well as affordable loans from state banks.

Let’s first look at his reference to goods coming from state-run companies.

Are these in any way different from other production inputs? Is there a reason why government needs to supply them?

If we look at, say, the Chinese steel industry, in terms of production, state-run companies have a market share of approximately 50%, with privately owned companies making up the rest. There are over 100 companies in total competing for market share. In other words, there is plenty of choice.

If we look at electricity, there we do indeed have fewer alternatives in China, with the state monopolizing supply. However, this is hardly a good thing, as evidenced by the widespread power outages China experienced in 2021. Luckily in this area there are a number of ways companies can generate their own electricity, for example by installing solar or thermoelectric power. These require upfront investment, but can ultimately be less expensive than what the state has on offer. It’s hardly a free market, but at least companies do have options.

Next, let’s look at what he says about preferential policies, for example preferential access to loans, tax breaks and other incentives. Presumably these are linked to the visionary planning he mentions.

In this area China does in fact have a fairly ‘competitive’ solution: namely, regionalization. Local and provincial governments have considerable leeway to offer special deals to incoming investors, and these understandably look for the best package deal. Often these deals are contingent upon the investor agreeing to pay a minimum of so and so much in taxes over the course of the deal. This is what happened in the case of Tesla.

One could perhaps characterize this as a kind of ‘government planning’, but only in the sense that the various governments competing for investment are market participants. This is light years away from Mao-era central planning. As Mr. Kanthan says, this creates a “win-win environment”.

That is true, and has indeed been a key factor in China’s rise to become the center of both production and industrial supply chains in the 21st century.

It is one part of a puzzle which, as we have seen, is intricate beyond the ability of any one person to appreciate in its entirety. And that is as it should be, because it makes it essentially impossible for the central planners to replicate. While they don’t always seem to grasp this fact, the market has a way of educating them.

Follow us on Twitter @AustrianChina.