Profiting from the trade war – why going long yuan is an asymmetric bet

Instead of complaining about dumb leaders, profit from market mispricing

View from China with an Austrian School of Economics Perspective

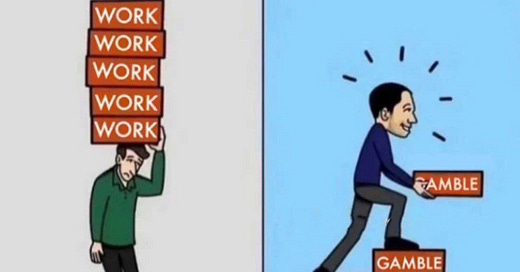

In a world where the money printers are ultimately the source of most wealth, it tends to pay to speculate. This is true of both China and the West. In the wake of the 2008 financial crisis, the primary central banks of the world, the US Federal Reserve, the ECB, the BOJ, the BOE and the PBoC, all embarked on mass money printing. 17 years of expanding the money supply each year by 10% or more have led to similar phenomena all across the industrialized world. Money printing inevitably leads to asset price bubbles, and this benefits the speculators, not the savers.

Most of the residents of China’s top tier cities – Beijing, Shanghai, Guangzhou and Shenzhen – have indeed been major beneficiaries of this. Most tend to own their homes, and many households have over the years held several properties. With most residential property rising by 2000% or more by the time the market peaked in 2019, many of these did very well, creating a substantial “speculator class” in the process.

Money Printing -> Asset Bubbles

Massive asset bubbles are the inevitable result of money printing, be they in the real estate sector, cryptocurrencies, stocks or precious metals. These all eventually burst, often repeatedly, before restarting once again, while leaving some impoverished and others enriched by the process. During the past 17 years, those who put their money into real estate, cryptocurrencies or US stocks tended to do extremely well, while those who opted for the Shanghai stock market were basically ruined. This was not because China’s economy wasn’t producing any winners; it produced lots of them, but these almost all listed abroad due to China’s overregulated domestic market, and then eventually crashed in price due to the massive fines and interventionism emanating from the post-2013 Beijing government.

With domestic stock prices going nowhere since 2015 and almost all forms of modern or innovative financial instruments (e.g. P2P lending, options or margin buying) either banned or severely limited, China’s financial industry was all but ruined. Industry salaries were in many cases cut in half (for gross annual compensation exceeding 3 million yuan in some cases retroactively!) while both China’s wealthy investors and its entrepreneurs fled to the world’s top casino and capital allocation machine: Wall Street. It surely borders on supreme irony that Chinese companies often look to the US for financing, when so much of the actual capital comes from China.

The Unsustainable Global Macroeconomic Equilibrium

This is of course the microeconomic mirror image of what was happening on the macroeconomic level: Surplus countries like China, Japan, South Korea or Saudi Arabia export their goods to the US in return for piles of US dollars, which then for the most part get funneled back to Wall Street to play the casino and allocate capital, as well as in recent years to profit from the 5% interest rates. These are now substantially higher than the risk-free returns which can be obtained in Japan, China or Europe, and this has helped sustain the system despite the orgy of new debt created in the years 2020-2021.

Each country has its ‘niche’ as it were. The US ‘niche’ is exporting dollars, its capital allocation services and its Wall Street casino fun, while China’s primary niche is manufacturing stuff. Europe, or more precisely, Germany, used to have a niche in exporting high value machinery, plus Europe in general exported tourism services. At this point it’s unclear if any of those niches remain.

There are a number of problems with the above scheme. The most obvious one is that it depends on a money printing machine which can in theory print endless amounts of the stuff, permitting (again, in theory) endless amounts of debt. If one of the parties to this game has a mercantilist policy backed by the largest economy in the world, as we have seen, levels of debt can accumulate which in times past would have been completely unimaginable. Note that this is not “normal” debt accumulated by individuals or companies, which always has natural limits. It is “artificial” debt created by the PBoC printing press.

This is not to say there is anything wrong with China or any other country running a trade surplus or even a temporary current account surplus. Perhaps it does make sense to allow a few countries like China to specialize in manufacturing, with other countries specializing in services. This would be a sustainable model. Exchanging all those goods for debt, by contrast, is at some point not sustainable.

Have Beijing’s mercantilists met their match?

View from China with an Austrian School of Economics Perspective

For those who think money printing is just great as long as the money gets spent on things they approve of, it’s worth keeping in mind that besides the incessant asset price bubbles and unsustainability problem, there are other issues, as well, like for example the fact that money printing inexorably leads to an ever-growing gap between the rich and the poor, both in the debtor AND the surplus countries. A fourth problem which is bizarrely almost never appreciated is the fact that China’s support for this system also allows the US government to finance wars and color revolutions all around the world (including in China!), something which would not be possible without it. That seems like a big downside to us.

But the heart of the issue is that this scheme amounts to central banks and their associated governments artificially fixing the price of money, by keeping the yuan, yen and won exchange rates artificially low. They are using the printing press to prevent markets from functioning, which with time cannot but lead to disaster. One of those disasters is the current state of business sentiment in China and the widespread reluctance on the part of Chinese consumers to consume.

The Crux of the Issue: US Dollar Overvaluation and Yuan Undervaluation

Let us be clear, this is not a question of fault. All the parties to the status quo are fully aware of how it works and equally share the burden of having created it. Moreover, all parties are surely aware that barring a war, a new equilibrium involving smaller US deficits and smaller Chinese surpluses can only be achieved via the pricing mechanism.

All the ranting one reads in social media about how the US is bound to “lose” the trade war, or how the US administration is ignorant about how best to deal with China is overlooking the fact that there is a real problem here: namely, that the current system is unsustainable.

If you listen carefully to US Treasury Secretary Bessent, for example during his recent speech to the Institute of International Finance, you will hear him repeatedly accuse China of currency manipulation, or “opaque currency practices.” The mentions are frequent, and it should not be hard to figure out what he is talking about. Reserve currency status comes at a price, and that price is typically the long-term overvaluation of one’s currency. Changing this cannot happen overnight, neither with 10% tariffs nor with 245% tariffs. Prices need to be adjusted, and that means exchange rates which are no longer fixed by central banks at highly unnatural levels.

The Opportunity

So we have three facts here:

1) The PBoC is printing massive amounts of yuan every year to prevent the yuan from rising against the US dollar. If this printing ever stops, a substantial exchange rate adjustment is the likely result. A comparable past event was the Swiss franc revaluation of 15 January 2015, when the Swiss National Bank stopped buying up euros, with the result that the Swiss franc immediately rose by 30%.

2) High tariffs are not sustainable. Something has to give, and soon.

3) The only real solution to increasing Chinese “consumption” is not helicopter money or more governments subsidies, but rather a yuan revaluation vis-à-vis the US dollar and euro.

Can both parties continue to kick the can down the road? Yes, they can, at least for a while. In that case exchange rates will most probably not move much.

But there is another possibility, and that is that the two parties agree on a yuan revaluation.

For the speculators out there, this is what’s known as an asymmetric bet. Whenever government intervenes in the market to artificially manipulate prices, it creates an opportunity for speculators. This is definitely one of those opportunities. The only question is when. Those with access to the Wall Street casino can buy unlimited amounts of CNH (offshore yuan) using US dollars and speculate on a yuan revaluation. The likelihood of a hefty CNH devaluation is low. The likelihood of a hefty CNH revaluation is substantial. Asymmetric. Is the chance of a revaluation 50%? Or only 30%? Any number would be a guess, but it’s certainly a number higher than, say, 10%. The primary cost of this bet is the interest rate differential, about 4% per annum. Not nothing, but not much compared to the potential upside.

Moreover, the more CNH speculators buy, the higher the pressure will be on the PBoC to permit the market to do its work. And that is surely a good thing.

Follow us on X @ AustrianChina

Two notes:

1) Whenever the PBoC (=the People's Bank of China, the central bank) decides to implement a revaluation, it tends to first depreciate the yuan a little bit to scare off speculators. In this case, something along those lines already took place shortly after the "liberation day" announcement, with the exchange rate sagging from around 7.3 to the USD to almost 7.4. Could that be repeated? Definitely.

2) The offshore yuan (CNH) is a separate currency which is not pegged exactly 1:1 to the onshore yuan (CNY). It tends to fluctuate a tiny bit more, especially overnight. However, it rarely drifts more than, say, 0.4% away from the CNY rate. In exceptional circumstances that could of course change, but for speculation purposes the only other choice is probably buying "RMB" futures on the CME.

I would intuitively think that, in order for China to offset the hurdles (i.e. tariffs) being imposed by the US, their best bet would be to DEvalue the yuan, so Chinese goods remain somewhat competitive...the revaluation of the yuan on top of the tariffs imposed by the US would result in China pricing itself out of the global market...no?