Profiting from China's Post-Corona Economic Rebound

The demise of zero-Covid could prove to be a market turning point.

View from China with an Austrian School of Economics Perspective

One week ago, on the morning of November 28th China time, the CNH exchange rate spiked down to 7.25 to the USD and 7.55 to the euro. Now one week later we are at 6.94 and 7.35. In other words, in only one week the yuan has risen by almost 4.3% against the dollar and 2.7% against the euro.

For those who don’t know, the CNH is the offshore yuan which is freely traded against the dollar and other major currencies.

Part of this recovery can be traced back to an across-the-board correction to the huge dollar pump we saw against almost all asset classes between June and October 2022. For example, the battered Japanese yen recovered over the past 6 weeks by about 10% from 150 to the dollar to around 134 today.

However, as we can see from the yuan’s rise against the euro, the yuan’s rise during the past week was broad-based and not just versus the dollar. To see this, the euro-yuan exchange rate is a better indicator than the dollar-yuan exchange rate.

During the same one-week period, Alibaba recovered by almost 33% from a low of 69.8 HKD to close at 92.65 today, with a total rise today of ~9% over Friday’s previous close of 84.8.

Whenever government policies change significantly, markets tend to be affected. If policies go from very bad to possibly better, there is doubly so the case.

This was true in June of 2022, when US-listed Chinese equities did indeed surge as we predicted on May 27th following the end of the Shanghai lockdown, and it is just as probable today.

So is it too late to take advantage of this?

If you believe that the policy reversal in Beijing is not temporary, then probably not.

Factors to be considered

Over the past 6 months, with the exceptions of bonds, we have consistently seen a significant correlation between most asset classes – be they equities, crypto, commodities or crypto. If the dollar rises, they fall. If the dollar falls, they rise. Remember, we are talking about the trend here, not absolute percentages. The yen fell much harder than any other major currency, and due to China’s zero-Covid policy, Chinese equities suffered more than any of the other major markets.

The elephant in the room driving much of this continues to be the US Federal Reserve’s ongoing squeeze of the money supply.

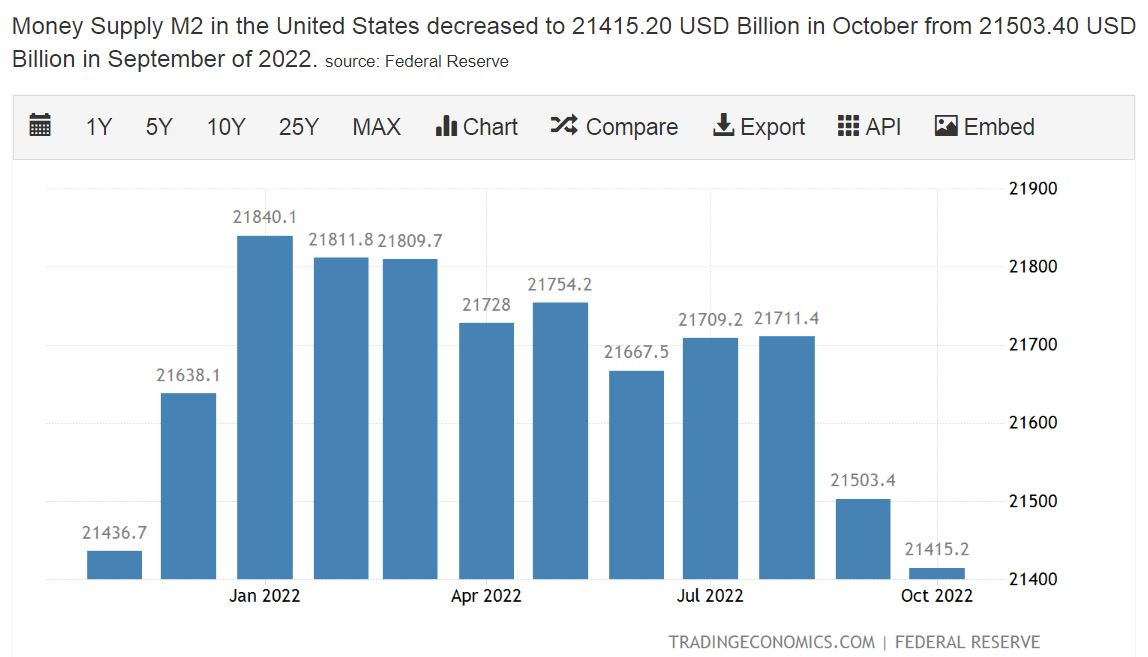

In our June 15th article entitled “Anatomy of a Squeeze” we discussed how the Fed’s on-off approach has driven asset prices worldwide up and down over the past two years. As indicated on the above chart, since then squeeze has continued. Year on year the US money supply is actually down slightly, with a 2% fall (!) between February and November 2022. This kind of actual sustained SHRINKAGE is almost unprecedented in recent monetary history.

By contrast, until the end of October 2022, the euro zone money supply was up around 5.5%, Japan about 2.6% and China about 11%.

All those PCR tests don’t come cheap.

During this same period, the Chinese yuan fell about 15%, the euro almost 20% and the yen over 30% vis-à-vis the US dollar.

Given the significantly tighter monetary policy in the US, we should not be surprised at the dollar’s strength relative to currency zones whose governments are printing more money. Moreover, while we can observe an obvious correlation here, we can also see that the move in exchange rates significantly overshot the differences in money supply growth. Forex traders know that this kind of overshooting is a common phenomenon.

Since late October, we are now in a correction phase. The correction applies to currencies, equities and crypto. Given the previous overshooting, this is also completely logical. How long will it last? With the yuan up by 5%, the previous overshooting has now been completely corrected. The Japanese yen and the euro, by contrast, still have a way to go.

How long will the correction continue? Or have we already seen the dollar peak?

It’s still too early to say, since thus far the Fed shows no sign of relaxing its tight money stance.

Moreover, the ongoing war in the Ukraine could also play a role. Even rumors of serious peace talks would likely push the USD down and everything else up.

Implications for traders and investors

If you are only looking at the comparatively stable currency markets, then one short term trade worth considering continues to be the EUR/CNH pair, since this eliminates the Fed uncertainty factor. USD/CNH probably has more upside potential, but it’s also riskier, especially since the interest rate gap is about 4%.

For Chinese and Hong Kong equities, while local market enthusiasm for a general economic recovery is likely to remain the primary factor, keep in mind that short term prospects are also subject to influence from Fed policy and US equity markets. In other words, if/when the recovery in US markets peters out or reverses, the sentiment reversal is likely to extend to Chinese markets, as well.

If by contrast you are playing a longer game and believe that the Covid theater is a thing of the past, then the argument for a long position in CNH, CNY and/or Chinese equities is strong.

Why? For one thing, just like China’s erstwhile zero-Covid policy, the Fed’s ongoing money supply squeeze also has an expiration date. Given the US government’s massive budget deficit, it cannot be sustained indefinitely. At the same time, many US-listed Chinese equities (中概股) are still trading at discounts of 60-70% or more vis-à-vis their previous highs. If we take Alibaba as an example, it is still 23% under its summer high water mark at 121 HKD. This means that despite the recent resurgence of US and Hong Kong listed Chinese stocks, your upside potential is probably still much larger than your downside risk. To follow this strategy, hold a long position, buy the dips and don’t forget to take some profits after a solid run-up.