Time to buy the Sun Chunlan dip?

Short and medium term prospects for the forex, crypto, precious metals and stock markets

View from China with an Austrian School of Economics Perspective

Yesterday Wednesday May 25th, Premier Li Keqiang held a “national teleconference” with government officials from all over China. The topic was reviving the economy. According to the Shanghai Daily, he said the following:

“The difficulties in March, and since April in particular, are in some respects and to a certain extent greater than those experienced in 2020 when the COVID-19 epidemic hit the country, marked by downward indicators for employment, industrial production, power consumption and cargo transportation, among others.”

In other words, not only is business confidence rock-bottom, the numbers are so bad that even the government feels compelled to admit it.

His solution? Development (“发展”). Whatever that means. Plus 33 measures to “stabilize the economy” and the timely distribution of unemployment insurance payments. In short: more central planning.

The markets don’t seem to feel inspired. This morning the Shanghai stock market responded by tumbling on opening.

True, the Shanghai stock has recovered somewhat since the crash in late April 2022, but it remains understandably unenthusiastic. The YINN Index by contrast (shown below), which “consists of the 50 largest and most liquid public Chinese companies currently trading on the Hong Kong Stock Exchange” remains close to all-time lows:

According to a survey of 2603 Shanghai SMEs (small to medium sized enterprises) conducted in late April 2022, less than 1% said they planned to make additional investments this year. Approximately 9% said that they still had confidence in the future.

Given the dire state of the Chinese economy and extremely low levels of business confidence, one has to wonder if the Shanghai market ‘recovery’ is not perhaps driven by something other than actual market sentiment.

This is however not the big story. The big story is the upside potential.

Upside risk versus downside risk

Anyone active in markets knows the adage about buying low and selling high. The reality is of course that most market participants tend to do the opposite: buy high and sell low. This is due to the understandable fact that profiting from buying ‘low’ often requires patience.

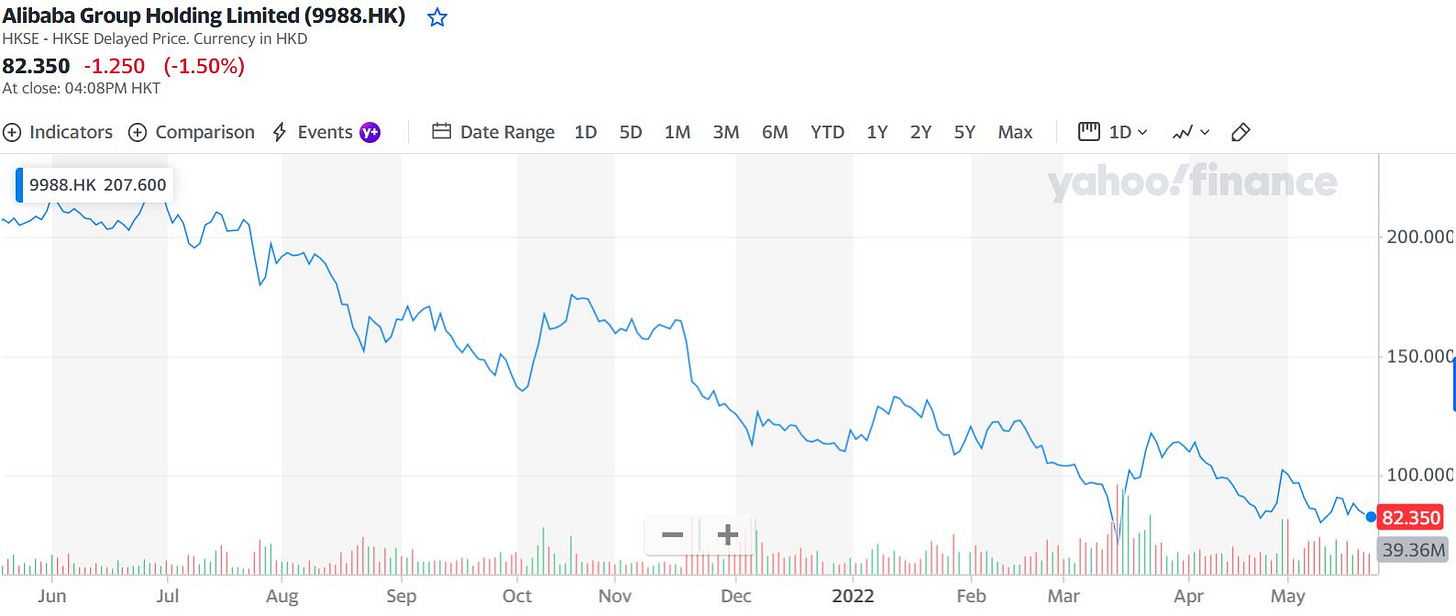

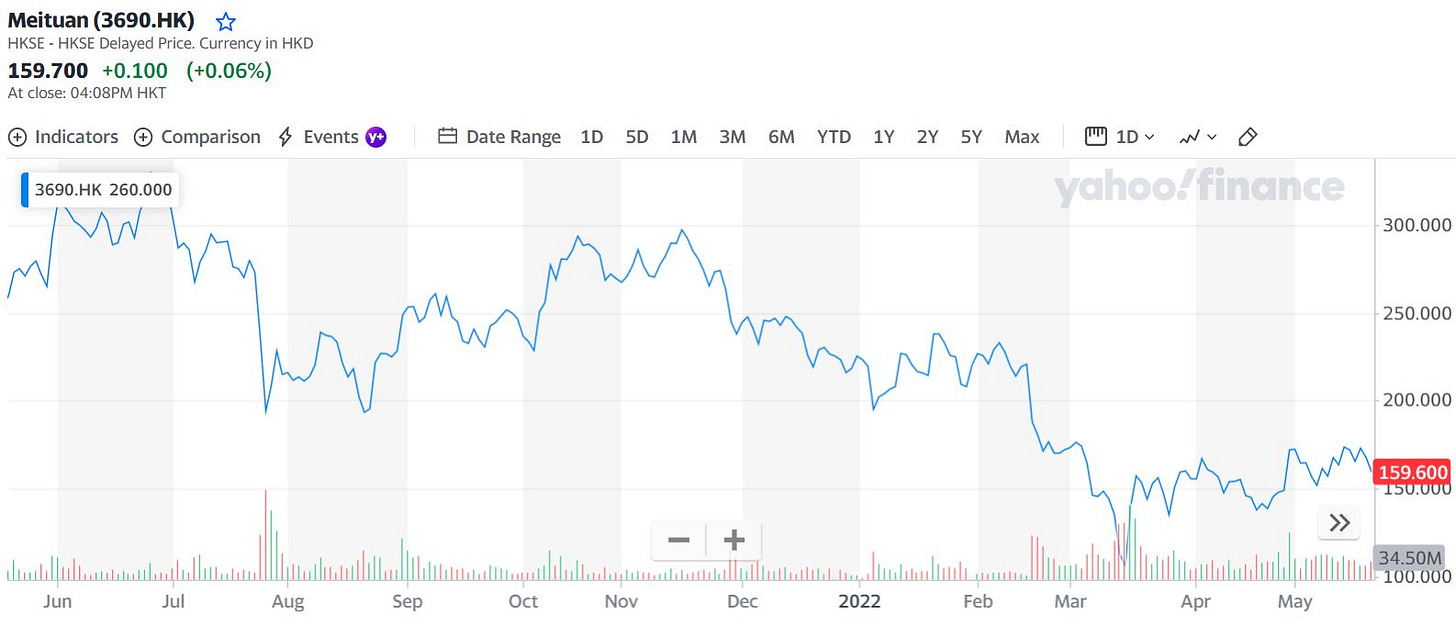

Only time will tell if these current ‘lows’ in the YINN Index end up being an actual bottom. However, what we can do is compare the downside risk to the upside risk. Investors should ask themselves, am I more likely to double my investment if/when the market recovers, or am I am more likely to lose half of my investment before my time horizon requires me to take the loss? The longer one’s time horizon, the less significant the downside risk. With some stocks such as Alibaba having fallen by 60% over the past 12 months, the recovery potential is substantial. Some stocks like Meituan, which have at least to some extent profited from the lockdowns, have performed better, but even Meituan is down 40% year on year.

As discussed in our previous article on China’s 2021 cancel culture, both Alibaba and Meituan were victims of an aggressive campaign against some of China’s leading private companies. Massive fines were levied: Alibaba was fined the equivalent of $2.8 billion; Meituan was fined ~$580 million, both for alleged “monopolistic practices.”

On March 16th 2022 China’s Ministry of Commerce announced that the witch hunt was over, leading to an immediate sharp rebound in prices.

Thanks to Sun Chunlan’s lockdowns, the rebound did not last for Alibaba. (See our previous story if the name Sun Chunlan doesn’t ring a bell.) And it’s hard to see how the market can recover without the government abandoning the current zero-Covid policy. But destructive policies such as the current one cannot last forever. Can it continue for one more month? Two more months? Three? Even three is hard to imagine.

Regardless of the exact timing, what is crucial to realize is that if/when a change of policy is in fact announced, then the market is likely to respond with a sharp move. This is because markets are inherently predictive. What counts is not the current situation, but rather the market’s anticipation of what is likely in the pipeline.

If you foresee China’s current government policies running into the brick wall of reality, then invest accordingly.

Geographic considerations

When investing in stock markets with an eye to holding the shares for an extended period, don’t forget that political earthquakes could affect your ability to liquidate your holdings. This is the case for example for investors holding Russian securities purchased through Western platforms. If the custodian is a Western entity such as Interactive Brokers, even a Russian investor holding Russian shares cannot access them, regardless of whether they were purchased in London or in Moscow. So if you plan to purchase shares in Chinese or Hong Kong companies, keep in mind that it’s safest to do so either in Hong Kong or on the mainland.

Forex markets – will the PBOC copy the Russian playbook?

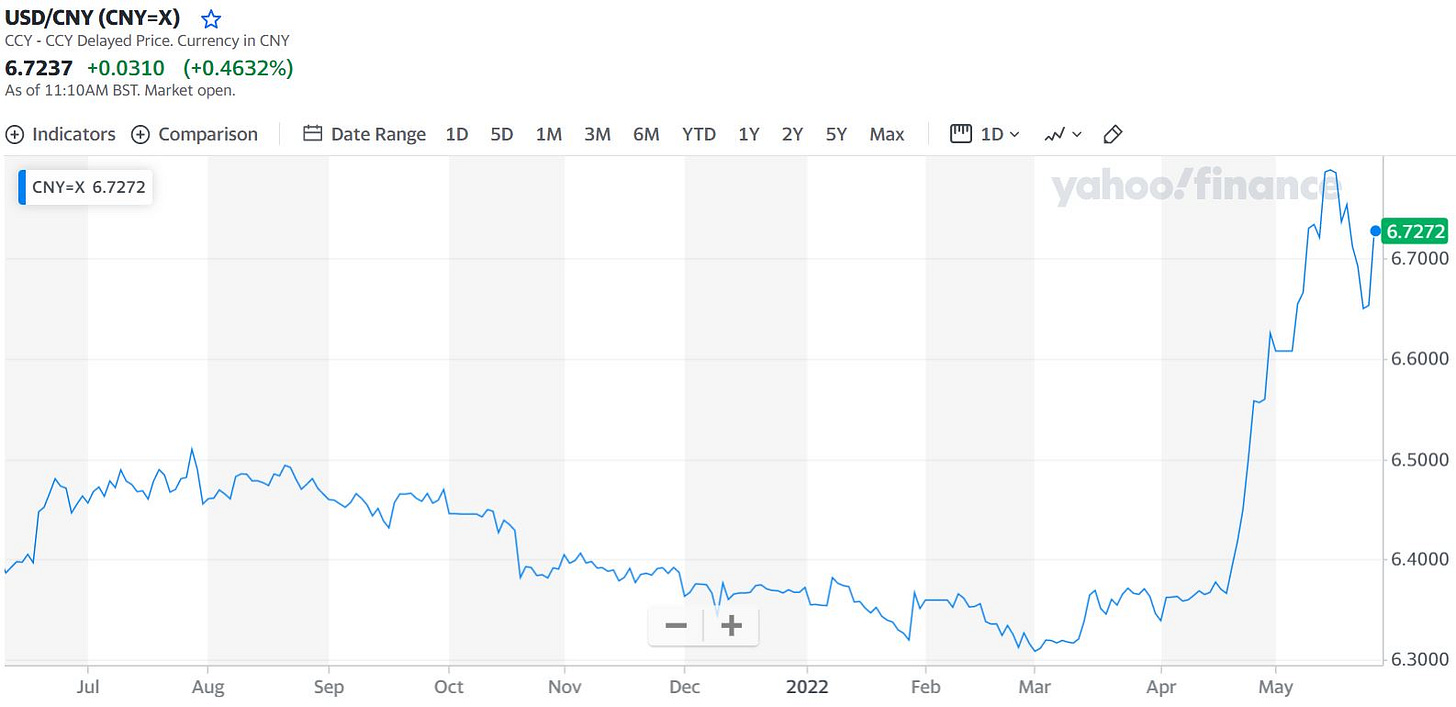

On the forex markets we have also seen a massive Sun Chunlan dip, with the yuan devaluing against the US dollar by almost 7% between April 19th and May 16th. This is a massive move and has been typically explained away with the weak economy.

But is this true?

China is sitting on a mountain of dollars and euros, over $3 trillion worth according to most reports. All of these dollars and euros are at risk of confiscation or freezing in case sanctions against China are implemented. According to a report which appeared in the Financial Times on May 1st, a meeting was held in Beijing on April 22nd to discuss “protect(ing) the country’s overseas assets from US-led sanctions similar to those imposed on Russia.” This was 3 days after the massive devaluation began on April 19th.

With such a massive war chest of (still accessible) foreign reserves, the reality is that this devaluation could only have taken place with the assent or support of the People’s Bank of China. Is the Sun Chunlan dip perhaps just an excuse? Upping foreign exchange receipts for domestic exporters could well be one motivation. This is after all a kind of economic stimulus. However, given the above-mentioned elephant in the room – the risk of China losing access to its reserves – might the alleged meeting on April 22nd be a more probable explanation? As experienced market watchers will know, a big move to the upside is often presaged by a smaller but significant move to the downside. Or vice versa. This serves to force-liquidate traders holding positions on margin, as well as to scare many others into selling. For CNY or CNH holders who are not optimistic about China’s economic prospects, selling or reducing their holdings might seem logical.

It’s noteworthy that this is precisely what happened to the Russian ruble in the past 3 months. First came a massive devaluation accompanied by panic selling. Then after several weeks, the trend reversed, to the point where 3 months later the ruble is now at a multi-year high.

The upshot? This could hint at a major upcoming revaluation of the yuan in the works. No guarantee, but it’s a scenario worth keeping in mind.

Crypto markets also at a 1-year low

Most of the world’s leading cryptocurrencies also declined significantly in value since May 2022. Since early May 2021, bitcoin declined approximately 50% year on year, with bitcoin trading today in a fairly tight range between $28,000 and $30,000. Most other cryptocurrencies fell far more. Is this an opportunity to buy low – “抄底” as it’s often termed in Chinese?

Interest rates for short-term US dollar loans hovering around 20% p.a., plus a heavy preponderance of long positions, hint that many retail speculators are betting on a rebound.

Let’s look at the evidence.

Ethereum, the world’s second most valuable cryptocurrency by market capitalization, remained in a narrow trading range vis-à-vis bitcoin during most of the previous 12 months, hovering around 7% of bitcoin’s value. Today however it fell out of that range, falling to 0.0625 versus bitcoin. This is obviously potentially a strong bear signal for the overall market, but also an opportunity to bet on an eventual restoration of the 14:1 peg to bitcoin.

As cryptocurrencies have become increasingly mainstream in the US, the overlap with trends in other major markets has become increasingly obvious. In other words, if the US dollar is strong, it tends to rise against all major assets classes including bitcoin, as well as the euro, precious metals and the stock market. If it is weak, then the opposite tends to be true. The correlations are not exact, but they are reflected both in intraday trading as well as in a long-term context.

Whereas the period between April 2020 and May 2021 was a period of extended dollar weakness and crypto strength, cryptocurrencies crashed in May 2021, muddled through the summer, then finally returned to strength in the fall. Bitcoin peaked on November 9th at around $67,000, while the US stock markets peaked in early January 2022.

If we compare the bitcoin charts with, say, the EUR/USD charts, it’s hard not to notice that major euro movements often seem to presage movements in the BTC/USD chart, albeit by 2-6 months. If this continues to hold true, then the current rebound in the EUR/USD rate hints at a bitcoin recovery in a few months, but not now. At a minimum this speaks for caution.

Another factor worth considering is bitcoin’s historical pattern of falling back to previous cycle highs before rebounding. In this case, the previous cycle’s high in December 2017 was around $20,000. This also speaks for caution at buying at current levels.

Finally, there’s the correlation with the US stock market. While the US markets are now in bear territory, thus far they have only fallen about 20% off their peak in January. Given the current dire state of most Western economies, in the medium term prospects remain gloomy. But what about the shorter term? After the fall we saw in the first 5 months, a limping rebound in the summer would not be surprising, especially if some kind of ceasefire should take place in Ukraine. Statements hinting at a new willingness to make territorial concessions were made both by Henry Kissinger in Davos and by the NY Times in its editorial published last Friday. Even if these moves do not ultimately lead to a ceasefire, the announcement of a new round of negotiations could be taken by the markets as an excuse to rebound. If the US equity markets recover, even weakly, expect bitcoin to follow.

Precious metals markets: gold & silver still waiting on the big breakout

Precious metals remain one of the few asset classes which have failed to appreciate in tandem with inflation since the summer of 2020, with gold remaining for the most part in the $1800-$2000 per troy ounce range. As we saw yet again during the recent crash in US equity markets, gold and silver do sometimes follow the same day to day trends. However, the correlation does not typically hold for long. While the US equity markets have remained in the doldrums, gold and silver both recovered substantially.

As all long-term market observers know, gold and silver prices, while highly manipulated, do tend to hold their value against inflation over time. There is no reason to believe that 2022 is likely to be any different. Moreover, in light of the geopolitical instability and the increasing cleavage in the world’s financial markets, a massive revaluation of precious metals vis-à-vis fiat currencies seems more a question of when rather than whether. So all in all, as is often the case, precious metals may not yield quick returns, but remain a fairly safe bet.

That brings us to our final point: where to hold precious metals assets.

If you are located inside China or have access to Chinese banks, several Chinese banks permit customers to hold balances in gold and/or silver. ICBC in particular comes to mind. These are probably fairly safe, since they are not likely to be affected by any possible default in the futures markets taking place in the US.

If you already have an account in Hong Kong, some banks in Hong Kong provide this option for gold. Hang Seng is one of them. These days it can however be very difficult for non-residents to open new accounts.

Singapore is a third option. Until recently, options to hold balances in gold and silver in Singaporean banks were almost non-existent. Now some banks do offer such accounts, though most require you to appear in person in Singapore to open them. Standard Chartered however does not require this.

A fourth option is to consider holding crypto gold, for example in the form of Tether Gold. Tether Gold is backed by physical gold in Switzerland.

All such options have counterparty risks. The bank could fold, or the exchange could default. In addition, holding metals (and other deposits) in a country in which you do not reside exposes you to potential sanctions and/or capital controls imposed on foreigners. Remember, we live in uncertain times. Uncertain times bring many risks, but of course also opportunities. Carpe diem.

the situation is hopeless but not serious. Anyway, never forget Murphy's law

You sound uncharacteristically upbeat about future prospects this time, compared to your previous articles! I'm not sure if this is just a dip like any typical dips before: something about China and also its perception in the world has been fundamentally altered. In the stock market, past behavior is usually a reasonable predictor for future performance, until we suddenly encounter events that are historically unprecedented.