Which country has the larger private sector, the USA or China?

The answer may not be the one you think.

View from China with an Austrian School of Economics Perspective

This article contains significant content drawn from this previous article on China’s 2021 Cancel Culture. This article is also available in Chinese here.

When the Chinese government implemented its new economic reform policy in 1980 (what is now called 改革开放), one important motivating factor was a desperate need for capital. Though there were bumps along the way, it eventually got that capital in spades, eventually becoming the world’s top destination for foreign direct investment in manufacturing.

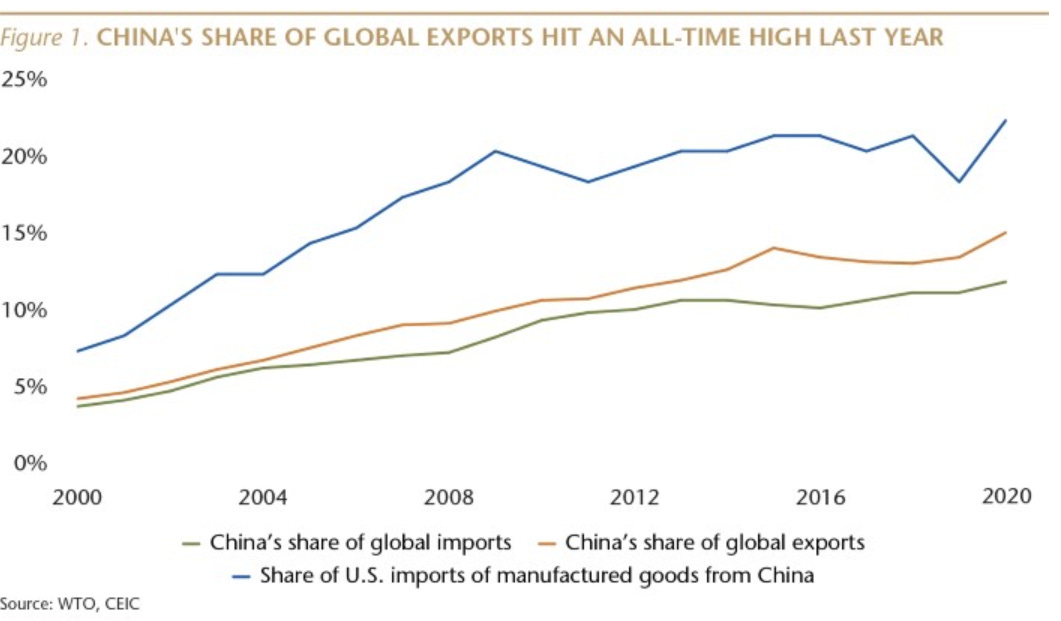

Since then, China has attracted more the $2.5 trillion in cumulative foreign investment. According to Chinese government data, as of the end of 2018, China had 960,000 foreign invested companies.

Something else happened along the way, however: bit by bit, thanks to high levels of savings China restarted its own internal capital accumulation process, to the point where foreign capital long ago ceased to be the primary source of new investment. In 2021 alone, fixed asset investment in China amounted to the equivalent of approximately $8.5 trillion US dollars1.

And yet, in its comparative index of economic freedom levels, the Heritage Foundation, a U.S.-based “research and educational institution whose mission is to build and promote conservative public policies,” would still have its readers believe that China offers a level of economic freedom on par with Uganda2. This fits the popular depiction in Western media of China as an authoritarian centrally planned economy with party officials calling all the shots.

Both Western socialists and much of the “conservative right” often seem to agree that China’s success is built on the back of this sublimely inspired central planning plus – in the case of many right wing pundits – “slave labor.” Yet if economic success really were that simple, why did the Soviet Union and Maoist China do such a miserable job of outperforming the West?

There seems to be a disconnect here somewhere.

Part of the answer may be found by correcting some widespread misimpressions about China’s private sector, and comparing China’s numbers with the situation in the West.

Here’s a typical example of the kind of misleading statement that leads to such misimpressions, in this case published by the World Economic Forum in May 20193. It reads:

“China is home to 109 corporations listed on the Fortune Global 500 - but only 15% of those are privately owned.”

Why is this misleading?

The primary reason is that that what counts in terms of economic impact is not the market capitalization of a company, but rather its share of the value added created in the economy.

According to Fortune Magazine, in the USA, Fortune 500 companies represent approximately two-thirds of the U.S. GDP with $13.7 trillion in revenues and $1.1 trillion in profits4. The share of Chinese GDP generated by the above mentioned top companies is by contrast far less.

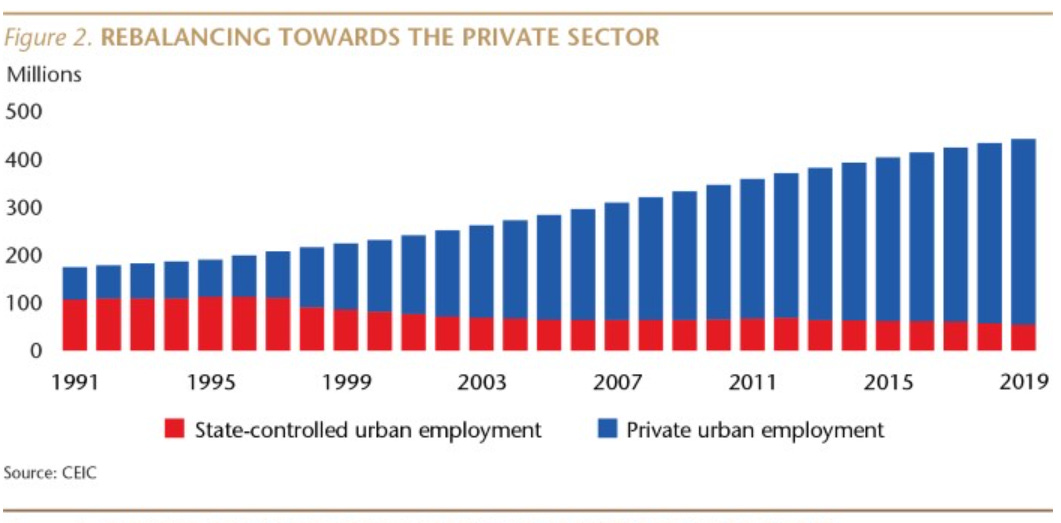

In terms of sales, exports, employment and investment, the share of the Chinese state-owned behemoths is comparatively small.

Just to cite a few statistics, the Chinese private sector generates ~93% of all new patent applications, ~85% of new investment in manufacturing and, on the net, 100% of all new jobs5. According to a study cited by Forbes in 2019, Chinese startups are much more likely to be privately owned and self-funded than, for example, those in Europe (72% versus 54%). These are contributions which state-owned enterprises cannot possibly replace. Most industries, including key ones such as payment processing and the IT/Internet industry, are completely controlled by privately owned companies.

As shown in the following analysis published by the World Bank in 2019, approximately 75% of China’s economy remains outside of the government’s direct control6, and there is no sign of a trend reversal.

Despite a clear trend towards heavier regulation, and despite the disturbing attacks on some of China’s top privately owned companies which we mentioned in our year-end wrap up post on China’s 2021 cancel culture, as of January 2022, China’s privately owned businesses for the most part remain highly competitive and – as a result – highly innovative.

And even where government does attempt to interfere, such as in social media, still there is a limit to how much it can sabotage using various forms of external coercion. Realistically we know from experience that government central planners cannot manage high levels of complexity. The more they try to plan, the more disastrous the results are.

What is the alternative?

The fact that China has attracted so much foreign investment plus its dominance of so many markets worldwide prompts the obvious question: what about China makes it so much more competitive than its Western counterparts?

To answer this question, we need to take a closer look at the situation in the West.

In marked contrast to China, in the West there is no adversarial relationship at all between big business and big government. On the contrary. In 2020, most of these businesses were declared to be essential, while many smaller companies were ordered to shut down. In the end, countless small and medium-sized businesses closed their doors forever, while sales and stock values for the top corporations soared.

Can all this chumminess in the West be simply an accident? A lucky quirk of fate? This seems unlikely. No, there is likely a very good reason for this, and though it is not a topic the Western financial press writes about, publicly available financial data provides some big clues: Within the group of the Fortune 500 companies mentioned earlier, in terms of common shares, the interlocking investment funds of Blackrock and Vanguard7 have controlling stakes in at least 80% if not 90%8 This means that at least 50-60% of the US economy is effectively controlled by Blackrock’s Larry Fink, while the non-Blackrock part of the economy is only 40-50%. The 80%+ of Fortune 500 companies controlled by Blackrock/Vanguard include companies as diverse as Facebook, Microsoft, Walmart, Amazon or McKesson.

Blackrock maintains a close relationship with both the US federal government and the US Federal Reserve, in 2019 even taking over management of the Federal Reserve’s $750 billion corporate bond purchasing program. Blackrock’s Aladdin asset management software is now in use by scores of companies, including according to some reports the Federal Reserve itself as well as several other central banks. As the UK’s Financial Times noted in 2017, Aladdin:

“…acts as the central nervous system for many of the largest players in the investment management industry – and, as the Financial Times has discovered – for several huge non-financial companies. Vanguard and State Street Global Advisors, the largest fund managers after BlackRock, are users, as are half the top 10 insurers by assets, as well as Japan's $1.5tn government pension fund, the world's largest. Apple, Microsoft, and Google's parent firm, Alphabet — the three biggest US public companies — all rely on the system to steward hundreds of billions of dollars in their corporate treasury investment portfolios.”

When considering such numbers, it should however be noted that some Fortune 500 companies have special share classes with enhanced voting rights. Two prominent examples of this are Meta (Facebook) and Alphabet (Google), both of which have special share classes with more voting rights controlled by the founders. As a case in point, while Blackrock/Vanguard through its various funds and sub-funds controls at least 29% of Meta’s common shares, Mark Zuckerberg with control of only ~10% of total shares still controls 57.7% of voting power.

Does that mean that Mark Zuckerberg can ignore Larry Fink’s opinions in his decision making? Probably not. After all, even aside from its influence over government, Blackrock still has the ability to destroy Meta’s stock price at any moment.

As a point of comparison, Blackrock controls at least 28% of the shares of Facebook’s “competitor” Twitter. At the end of 2019, former CEO Jack Dorsey owned 2.3%. In its proxy statements submitted to the SEC, Twitter does not mention any special share classes.

Blackrock/Vanguard also controls at least 27.3% of Pfizer and 25.3% of Moderna, both huge beneficiaries of the printing press in 2021. Though not impossible, it is very difficult to outvote a shareholder with a 25% interest, especially one with the kind of influence Blackrock has.

As Fink himself made clear in his 2017 Letter to CEOs, Blackrock is not a passive investor, and when Blackrock issues political mandates (such as the vaccine mandate issued in mid-2021, or mandates to sanction products from Xinjiang), for the most part his CEOs have no choice but to follow suit, regardless of the impact on their bottom line.

Are these Blackrock companies comparable to China’s state-owned enterprises (SOEs)? Perhaps not in all senses, but in many. For Western readers wishing to understand the key differences between China’s economy and that of the West, this point is absolutely crucial. Both are by definition non-competitive and subject to all the ills of central planning. Just like China’s SOEs, Blackrock has de facto direct access to the central bank’s money printing machine and their top staff regularly rotate in and out of government regulatory agencies9.

For both Blackrock and China’s state owned enterprises, political considerations are the bottom line, not economic ones. In many US industries, literally every major company is controlled by Blackrock, which necessarily limits the degree of real competition.

While there are many similarities, there is one huge difference between China’s SOEs and the Western Blackrock companies. Chinese SOEs make up only ~25% of the Chinese economy, a number which pales in comparison to the 60%+ share Blackrock enjoys in the US10. In the US and to a large extent in Europe – though less well documented there – Blackrock has become a kind of central planning establishment. In 2020-2021 the reality of this central planning revealed itself in countless ways, but perhaps the most obvious one was in Blackrock’s ruthless exploitation of the once flourishing social networks it controls. Facebook and Twitter’s long-term market dominance and commercial success were sacrificed on the altar of Blackrock’s political agenda. Control and manipulation of public opinion are key components of any power structure, and events of the past two years have proven that Blackrock (or the people who control Blackrock) have both the ability and the willingness to use this control.

The upshot

Is China’s highly competitive private sector its key to its relative success? Is the increasingly monopolized control over industries in the West the key factor in explaining its relative weakness? Assigning a weighting to these factors may be difficult, but that does not prevent us from guessing that these factors may indeed play a major role.

By contrast, the three former British colonies Singapore, New Zealand and Australia – three of the countries with the strictest and longest lockdowns in the world over the past two years – are said to offer the highest levels of economic freedom.

Statistics from 2017. Source: 2019年中国民营经济报告, https://baijiahao.baidu.com/s?id=1647322086137116909

These include Vanguard, Blackrock, State Street and many others, many of which seem, to a large extent, to own each other. Blackrock’s largest shareholder is Vanguard, and its second largest shareholder is itself. These funds also manage mutual funds whose shares they vote. Blackrock’s CEO Larry Fink is the most public face of this group, hereafter referred to as “Blackrock” for simplicity purposes. The real beneficiary shareholders are not a matter of public record.

This article provides several examples: https://www.businessinsider.com/what-to-know-about-blackrock-larry-fink-biden-cabinet-facts-2020-12.

Blackrock, Vanguard and their other associated funds also have massive stakes in leading European companies, but the degree of control in Europe is much less well documented. They also have some stakes in Chinese companies listed overseas, which the Chinese government seems to regard with great suspicion. However, in percentage terms, their Chinese holdings are insignificant.

This question “Are these Blackrock companies comparable to China’s state-owned enterprises (SOEs)?” read with your year end review piece deserves a much broader audience.

try to send it to peer review journal, and let's see